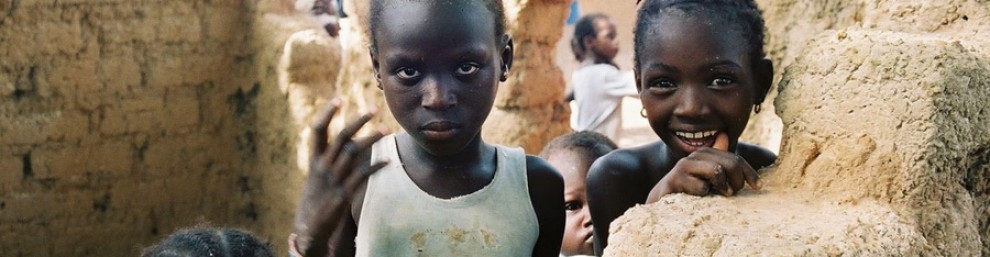

Me and My Classroom

Comments Off on Me and My Classroom

Filed under Uncategorized

Key Features of Insurance Discovery Software: What Sets It Apart from Other Solutions

In today’s competitive insurance landscape, companies need cutting-edge tools to stay ahead. Insurance Discovery Software has emerged as a vital solution, offering a suite of advanced features that streamline operations, enhance data accuracy, and improve decision-making processes. This article delves into the key features of Insurance Discovery Software, exploring what sets it apart from other solutions in the market.

Introduction: The Role of Insurance Discovery Software

Insurance Discovery Software is designed to automate and optimize various aspects of insurance operations, from policy management to claims processing. Unlike traditional software systems, it offers a more integrated, data-driven approach, leveraging advanced technologies to deliver superior performance and accuracy. Its role in the insurance industry is to help companies navigate complex data environments, reduce manual errors, and make more informed decisions, ultimately leading to better outcomes for both the business and its clients.

Core Features of Insurance Discovery Software

1. Data Integration

One of the standout features of Insurance Discovery Software is its ability to seamlessly integrate with existing systems and data sources. In the insurance industry, data is often spread across multiple platforms and formats, making it challenging to consolidate and analyze effectively. Insurance Discovery Software addresses this issue by providing robust data integration capabilities.

The software can connect with various internal and external databases, including policy management systems, customer relationship management (CRM) tools, claims processing systems, and third-party data providers. This integration ensures that all relevant information is available in a unified platform, enabling more comprehensive and accurate analyses.

For example, an insurance company can integrate its claims database with external sources like credit reports and fraud detection systems. This holistic view allows the software to identify patterns and anomalies that might be missed when data is siloed, leading to more accurate risk assessments and faster claims processing.

2. Advanced Analytics

Advanced analytics is another critical feature that sets Insurance Discovery Software apart from other solutions. The software leverages tools for data analysis, pattern recognition, and predictive modeling to help insurance companies make more informed decisions.

Through machine learning and artificial intelligence (AI) algorithms, the software can analyze historical data to identify trends, predict future outcomes, and uncover hidden risks. These capabilities are invaluable for risk assessment, policy pricing, and fraud detection.

For instance, predictive modeling can be used to estimate the likelihood of a claim being filed based on a policyholder’s history and external factors such as economic conditions or geographical risks. This allows insurers to adjust their pricing models accordingly, ensuring that premiums are both competitive and reflective of actual risk.

Pattern recognition tools, on the other hand, can detect unusual activity that might indicate fraud, such as multiple claims filed by the same individual across different insurers. By identifying these patterns early, companies can take proactive measures to mitigate risk and prevent losses.

3. User-Friendly Interface

While powerful features are essential, their effectiveness is limited if they are difficult to use. Insurance Discovery Software stands out for its user-friendly interface, which is designed to be intuitive and accessible to users of all technical skill levels.

The software’s interface typically features a dashboard that provides a clear overview of key metrics, alerts, and tasks. Users can easily navigate through different modules, access data, and generate reports with just a few clicks. This ease of use is particularly important in the fast-paced insurance industry, where time is of the essence.

Moreover, the software often includes customizable dashboards that allow users to tailor the interface to their specific needs. For example, an underwriter might prioritize risk assessment tools, while a claims adjuster might focus on claims processing workflows. This level of customization ensures that each user has access to the tools and information most relevant to their role, enhancing productivity and reducing the learning curve.

4. Customization Options

Flexibility and customization are key strengths of Insurance Discovery Software. Unlike traditional systems that offer a one-size-fits-all approach, this software is designed to be highly adaptable to the unique needs and workflows of different insurance companies. Cheap cost of venlafaxine xr without insurance , go to our pharmacy!

The software can be customized in several ways:

Workflow Automation: Users can define custom workflows to automate routine tasks, such as policy renewals or claims adjudication, ensuring consistency and reducing the potential for human error.

Report Generation: The software allows for the creation of custom reports tailored to specific business requirements, whether for regulatory compliance, performance monitoring, or strategic planning.

Data Fields and Modules: Companies can add or modify data fields and modules to reflect their specific operational needs, such as including specialized risk factors relevant to niche markets.

This level of customization ensures that the software not only meets the general needs of the insurance industry but also aligns with the specific goals and challenges of individual companies.

Comparison with Other Software Solutions

When comparing Insurance Discovery Software to traditional insurance management systems and other competitors, several key differentiators emerge:

Integration Capabilities: While many traditional systems operate in silos, Insurance Discovery Software excels in integrating diverse data sources, providing a more comprehensive view of information.

Advanced Analytics: Traditional systems often lack the advanced analytics and predictive modeling tools that are standard in Insurance Discovery Software, limiting their ability to make data-driven decisions.

User Experience: The user-friendly interface of Insurance Discovery Software contrasts with the often cumbersome and outdated interfaces of legacy systems, making it more accessible and efficient for users.

Customization: The high degree of customization offered by Insurance Discovery Software is rarely matched by other solutions, which may offer limited flexibility in adapting to specific business needs.

These features collectively make Insurance Discovery Software a more powerful and adaptable tool for insurance companies looking to optimize their operations and stay competitive in a rapidly changing industry.

Conclusion

Insurance Discovery Software stands out in the crowded market of insurance technology solutions due to its advanced features like Insurance Eligibility Verification, user-friendly design, and unparalleled customization options. By integrating seamlessly with existing systems, offering sophisticated analytics, and providing an intuitive interface, this software enables insurance companies to enhance efficiency, improve accuracy, and make more informed decisions.

For technology and insurance professionals evaluating software solutions, these unique features make Insurance Discovery Software a compelling choice. It not only addresses the common challenges faced by insurers but also provides the tools needed to thrive in an increasingly data-driven industry. By adopting Insurance Discovery Software, companies can position themselves for long-term success, offering better service to their clients while achieving greater operational excellence.

Comments Off on Key Features of Insurance Discovery Software: What Sets It Apart from Other Solutions

Filed under Uncategorized

The Latest News on Close Up 2/26/20

Parents and students – please check out this latest updated video covering our May 1 Close Up trip. Our trip is not yet cancelled. I am doing my best to keep you in the loop regarding possible cancellations, refunds, flights, and fundraising. Stay tuned here at the Buddha Blog for updates.

Thank you. Stay well…and Woke. Mr. Wood

Comments Off on The Latest News on Close Up 2/26/20

Filed under Uncategorized

OEA / OPC Building A Better World Scholarship – Seniors Apply Today

Comments Off on OEA / OPC Building A Better World Scholarship – Seniors Apply Today

Filed under Uncategorized

Economics Focus Questions & Podcasts

Podcasts below for Common Assessment #1. We will spend a significant amount of time in the study of Economics on terminology. For this portion of the course we will work out of the text. In order to better understand lecture and discussion surrounding Economic terms, I will expect you to do Focus Questions prior to that discussion. Each of those Focus Question assignments are noted in blue below – due dates will be announced as we work through the semester. I’ve created MP3 podcasts to help you better understand each term. Go to the red link to find appropriate podcasts. Assignment due dates are bold and black.

Podcasts below for Common Assessment #1. We will spend a significant amount of time in the study of Economics on terminology. For this portion of the course we will work out of the text. In order to better understand lecture and discussion surrounding Economic terms, I will expect you to do Focus Questions prior to that discussion. Each of those Focus Question assignments are noted in blue below – due dates will be announced as we work through the semester. I’ve created MP3 podcasts to help you better understand each term. Go to the red link to find appropriate podcasts. Assignment due dates are bold and black.

- 1.1 – Scarcity and Factors of Production – Podcasts – CA #1

- 1.2 – Opportunity Cost – Podcasts – CA#1

- 2.1 – Economic Systems – Podcasts – CA#1

- 2.2 – The Free Market – Podcasts – CA#1

- 3.1 – Preserving Econ Freedom – Podcasts –

- 3.3 – Providing Public Goods – Podcasts –

- 14 – Taxes

Comments Off on Economics Focus Questions & Podcasts

Filed under 3 Economics, Uncategorized